Enterprise Technology Solutions

LeafHouse GPA®

Institutional Investment Customization

Allows broker-dealers and advisory firms to offload their Backoffice 3(38) work via either subadvisor or fund fulfillment agreements

Downloads 27 million data points on over 100,000 different investments from multiple sources

Includes dozens of direct data feeds from national recordkeepers and global fund companies (i.e. American Funds and Franklin Templeton)

Disseminates fund peer to peer investment scoring across thousands of retirement plans and advisory relationships

Enables the FlexFiduciaryTM offering and true unrivaled customization which takes input from advisors, program partners, and/or plan sponsors

Preferred Fund Families

Active/Passive Investment Approach Preference

Expense Ration Target

Broker-Dealer and/or larger RIA looking to create their own 3(38) solution can partner with LeafHouse.

reallocateIT™

Personalization for the Everyday Investor

Technology that has upended the managed account space in the retirement plan industry

Delivers personalized portfolios up to 27 times per second

Able to reallocate approximately three million accounts per day automatically

No human interaction is needed

Can consume various industry managed account structures

Can support flexible capital market strategies

Can operate as a white label solution for brand conscious partners

Does not interrupt the advisor investment selection process

True digital API infrastructure cloud based solution

This is developed for Broker-Dealers, RIAs, Asset Managers, and/or Recordkeepers looking for managed account technology.

Contact LeafHouse today to learn more.

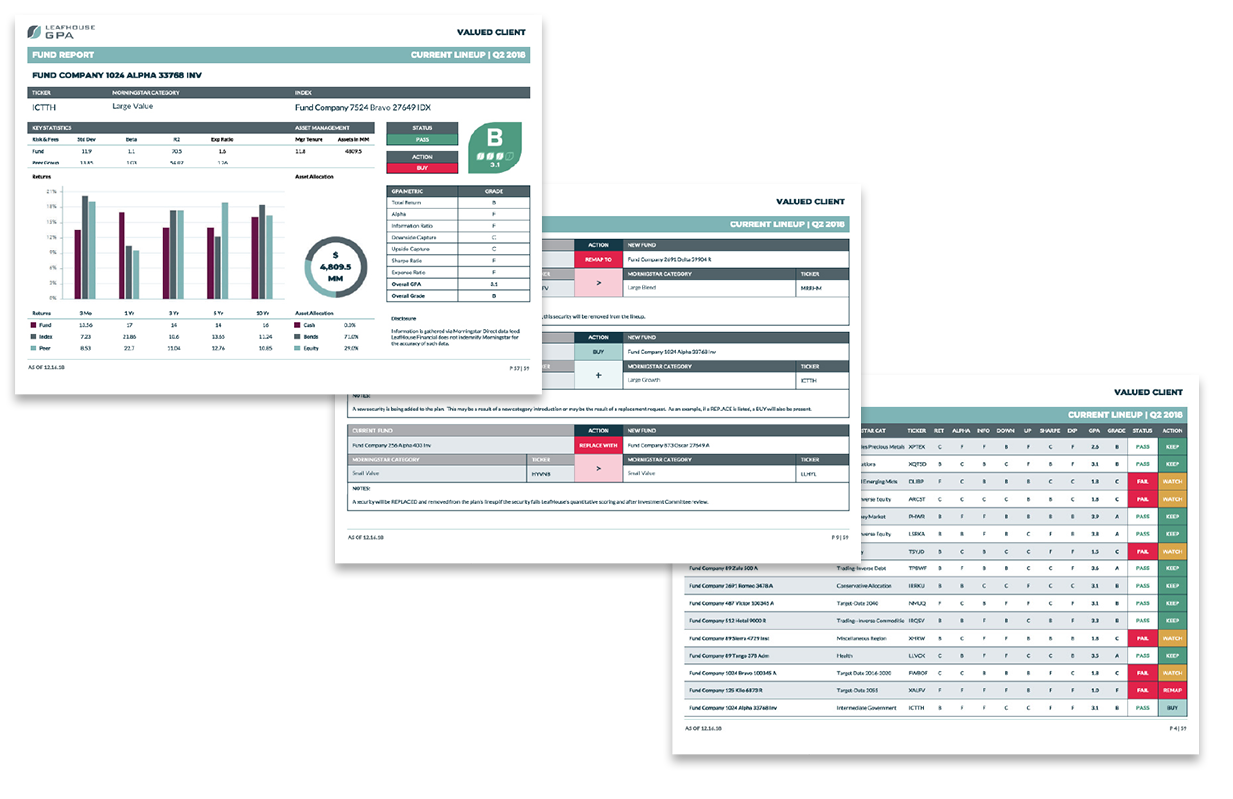

investGrade™

Data delivery and industry support

Cloud-based software solution that provides transparency to advisors, broker dealers, recordkeepers, and mutual fund companies

OCIO platform for advisors to easily manage their book of business

Provides a forward-facing user interface for the investGrade GPA fund scoring system

Can operate as a white label solution for brand conscious partners

Provides a supervisory platform for federally regulated financial services firms

Improves industry communication related to the private sector retirement industry

investGrade is made for:

Asset Managers searching for investment data transparency and higher levels of efficiency

Advisory Firms aiming to manage their retirement practice by aggregate their book-of-business, receive book of health performance, and access a fund measurement system

Recordkeepers focused on automating their business analytics to protect and drive new business growth

Take control of your data and contact LeafHouse today, or explore www.investGrade.com